CEU down the line in receiving legislative funds

This year’s Utah legislature decided to leave student needs down the line in priority, as the transportation department received the spotlight and the funds noted local Representative Brad King.

The session took place from January 16 through March 1, and consisted of many issues regarding the state of Utah. Two issues that have the highest priority are the budget, and bills that need to be amended, changed or killed.

This archived article was written by: Benjamin Waldon

This year’s Utah legislature decided to leave student needs down the line in priority, as the transportation department received the spotlight and the funds noted local Representative Brad King.

The session took place from January 16 through March 1, and consisted of many issues regarding the state of Utah. Two issues that have the highest priority are the budget, and bills that need to be amended, changed or killed.

The budget is figured mainly through three types of taxes: the state income tax, the sales tax and the gas tax. All of the state income tax is distributed among all types of education, K-12 and higher education alike. The way in which the money is distributed is up to the education- related committees to decide.

All of the gas tax is distributed to the building and repairing of roads in the state of Utah. The money is distributed to what the associated committee decides upon.

Sales tax is then distributed to the rest of the government functions such as job services or highway patrol.

Present with the politicians at the legislature is fiscal analysts who help the decisions on where the money should be spent, and how much of it should be spent in one area. The goal is to make the money most useful, and beneficial for the state of Utah and its residents.

The main goal of the legislature this year was transportation. To help with the gas tax income that the department received to build and fix roads, there was an additional $200 million that was provided to support transportation.

Higher education was looked at as lower priority next to transportation and public education. The higher education department received a total of $1,099,975,500 to fund every institution in the state.

Although this is a 3.7 percent increase in the amount of money higher education received last year (2005); it does not compensate the gap created by the economic rise in prices of gas and utility bills, therefore causing many of the institutions in the state to increase their tuition costs.

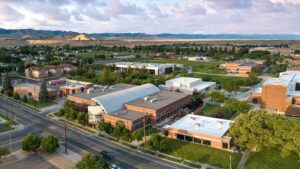

In total, the College of Eastern Utah, Price campus, has received $13,228,300. This number falls millions short of the financial operating needs of the college considering that the total bill is around $20 million, causing CEU to raise their tuition by 8.5 percent says Rep. King . Other minimal amounts were received from the CEU’s Prehistoric Museum and San Juan Campus, which totals about $4 million.

The percent increase across state is more of a crash with Dixie increasing their tuition by 30 percent.

Many educational-related bills were discussed during the session, more of which passed than failed. Some of these bills that passed included: the accessibility of electronic text books at no additional costs for disabled students, and an amendment proposed by Rep. Kory Holdaway concerning New Century Scholarships which made it so that students are still eligible for this scholarship “by completing an associate’s degree or by completing a math and science curriculum as approved by the Board of Regents with a ‘B’ average.”

There were many bills that did not pass, many of which had to deal with K-12. One submitted by Sen.. Bill Hickman, “Appropriates $11.5 million to seven Utah System of Higher Education (USHE, this includes CEU) institutions to enhance, begin, or expand specific programs” did not pass because of the lack of funding that HE received. Many tax cuts took place, one of which will decrease sales tax by two percent. If the economist prospective holds, and the economy continues doing well, the decrease in income tax should make it more profitable for HE institutions, King says.