Out with the old, in with the new

esidents allows time to assess and sell the president’s old house due to its lack of needed commodities and costly upkeep.

The home was sold to Tony Basso last week for over $266,000 according to vice president of Finance and Administrative Services Kevin Walthers.

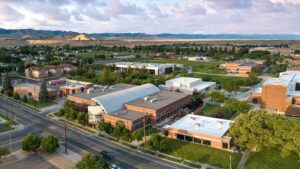

According to Walthers, there will be no time wasted in the building of the new president’s house on the adjacent side of campus, as can be seen on the newly approved master plan.

This archived article was written by: Kris Kohler

esidents allows time to assess and sell the president’s old house due to its lack of needed commodities and costly upkeep.

The home was sold to Tony Basso last week for over $266,000 according to vice president of Finance and Administrative Services Kevin Walthers.

According to Walthers, there will be no time wasted in the building of the new president’s house on the adjacent side of campus, as can be seen on the newly approved master plan.

“Our anticipation is to locate the new home on the northeast corner of 600 North and Veterans Lane,” said Walthers. “This provides us with an elevation change that will allow for a walk-out basement and gives the best mountain views from the back of the home.”

College officials have had preliminary discussions with the city about utilities and zoning and report no problems there.

“The old house was not in good condition, it needs an entirely new kitchen from the floor up. The deck probably needs to be replaced, the sprinkler system is in disarray and the bathrooms are dated,” said Walthers. “There is no doubt the home would need a near total makeover to get it up to par.”

College facility managers recently assessed the home and determined that a complete update of the house would cost from $30,000 to $50,000 minimum, depending on finishes and bid climate.

According to Walthers, a further issue with the home is that it is not as capable for entertaining, as one would expect with a college residence. The steep driveway and limited access road hamper parking, making it difficult to hold large events at the residence. In the winter, the driveway is dangerous and difficult to maintain snow removal.

The college obtained an appraisal of the home that estimated a value of approximately $260,000. The funds allocated from the sell of the property will provide the means to replace the residence.

The likely location for the home will be on land already owned by the college and utilities are readily accessible. The land is zoned “educational” and should allow for the addition of a campus residence. IRS rules require the home to be located adjacent to campus for a president to avoid incurring the tax associated with this benefit, concluded Walthers.