Life isn’t cheap

Life isn’t cheap, I think that we know that. In one way or another, it seems that in today’s economy, everyone is suffering financially. So how is it that so many of us are going to college? How is it that so many of us are affording college? The fact is that we are all getting into a dangerous financial situation in our lives, why? We’re taking out too many student loans. We’re getting into debt that we can never afford to repay.

This archived article was written by: James Justice

Life isn’t cheap, I think that we know that. In one way or another, it seems that in today’s economy, everyone is suffering financially. So how is it that so many of us are going to college? How is it that so many of us are affording college? The fact is that we are all getting into a dangerous financial situation in our lives, why? We’re taking out too many student loans. We’re getting into debt that we can never afford to repay.

Kim Booth, USU Eastern director of the financial aid office, says, “Too many students today don’t embrace the ‘poor college student’ mentality, I try to get them to do that. When you‘re in college, you don’t have to have the newest smart phone, or the best car, all that kind of stuff… you don’t have to have what your parents have, or have to have the ideal life while going through college, that’s what we try to talk them out of…

“The one thing that people don’t understand about student loans is you have to pay them back. I know this sounds silly, but I see it all the time… We have a new mentality emerging in students, it’s the mentality of, ‘I want the most loan money I can get,’ this is a very dangerous mentality.”

According to msnmoney.com, the average student with a bachelor’s degree has about $25,000 in student-loan debt; the average student-loan payoff is 10 years. With subsidized interest rates at 3.4 percent and unsubsidized interest at 6.8 percent, if you were able to do 50 percent of that loan subsidized, 50 percent unsubsidized, your payment would be about $270 a month. To borrow that $25,000, you have to pay back over $32,000. The government and loan servicing companies are making about $7,000 off you. (Keep in mind that in my calculation, I do not add the interest that acquires on unsubsidized loans. Unsubsidized loans the interest acquires while in college, subsidized loans it doesn’t start until you get out of college.)

One area that is seeing an increase in student-loan applications and debt are the “for profit” colleges. These are colleges like Stevens Henager, University of Phoenix, LDS Business college, Westminster, etc. These colleges are so expensive that students are forced to take out loans to pay for their tuition. Take Westminster for example, one year costs just over $27,000. Most students who attend “for profit” colleges will not graduate. Those that do graduate find that they don’t have the skills or education for a well-paying job, making “for profit” college loans extremely hard to repay.

According to Huffingtonpost.com, student-loan debt in the United States has topped one trillion dollars, ($1,000,000,000,000). Last year, student’s borrowed more than $117 billion dollars, ($117,000,000,000). Student-loan debt passed all credit-card debt and car-loan debt.

“It’s getting far harder for students to pay off their loans,” says Alan Collinge, of Student Loan Justice, an organization that lobbies for student loan reform. “Student loan debt has reached overwhelming proportions. This is a burden no other generation has had to face.”

There is help though. The Utah Higher Education Assistance Authority, UHEAA, is more than likely the organization that services your loan. They offer deference and forbearance programs, which will give you an additional six months to a year without making payments. Not everyone qualifies, but if you need some time to get back on your feet, this is what these programs are for. They also have the power to extend the time you have to repay your loans from 10 years, to 20 and even 30 with extreme circumstances. But, we need to realize that when repayment programs get extended, the interest that is paid becomes a lot more.

There is also another program called the loan forgiveness program. With this program you either work with an accepted employer in an accepted field, or you volunteer; some of the accepted fields are: medical, teaching, lawyer and paralegal, law enforcement, or volunteer with AmeriCorps or the Peace Corps.

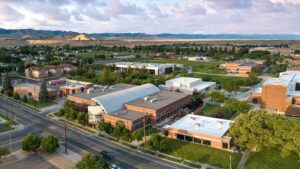

College is extremely expensive and the costs are always going up. At USU Eastern, we’ve seen tuition increases over the past few years of about nine percent yearly, this year however, it’s six percent.

With costs continuing to raise how do we go about not drowning ourselves in student loan debt? Here are some suggestions of how to keep student loans down that I was able to find online; live at home if possible; study at a community college for as long as possible; buy used everything, books, clothes, vehicle, etc.; cut back on unneeded expenses; join the ROTC; work, never take out private loans and setup a personal budget.

We are at a crisis in America. One trillion dollars is more money than we’ll ever see, we’ll ever touch and we’ll ever payback. Let’s start being responsible with our loans so that when the 61 percent of us graduate we don’t have an overbearing payment. One last thing, let me emphasize this, if you know about the interest, about the payments and still want to take out student loans, do it. Taking a chance and investing in yourself is one of the best things you can do, just do it smart.